Waterfalls and Hurdle Rates in Real Estate Private Equity

What is better—tiered returns or pari passu? It’s up to you.

Private equity organizational structures have various merits and demerits. As appraisers, we see a variety of entity structures—partnerships, limited liability companies (LLC), corporations—all organized in different ways, which makes understanding the governing documents of an entity essential to understanding the value of an interest in that entity. Some of the most common reasons for the variety of organizational structures include optimizing wealth transfer in estate planning, tax planning, liability mitigation, incentive alignment, and role allocation based on what each partner brings to a deal.

As an asset class, private investment in real estate has grown substantially in the 21st century. In fact, it was not until the 1990s that real estate private equity in the form of pooled funds for investment in real estate became popular. These funds grew out of private investors pooling to take advantage of falling real estate prices in the early 1990s and have continued to grow in popularity, especially in the build up to the Great Recession. In all economic cycles, investors choose real estate to add diversification to their portfolios, and because the assets are income producing, hedge against inflation, and are tangible. Within real estate private equity, there is a common entity structure that seeks to align entrepreneurs and investors: the equity waterfall.

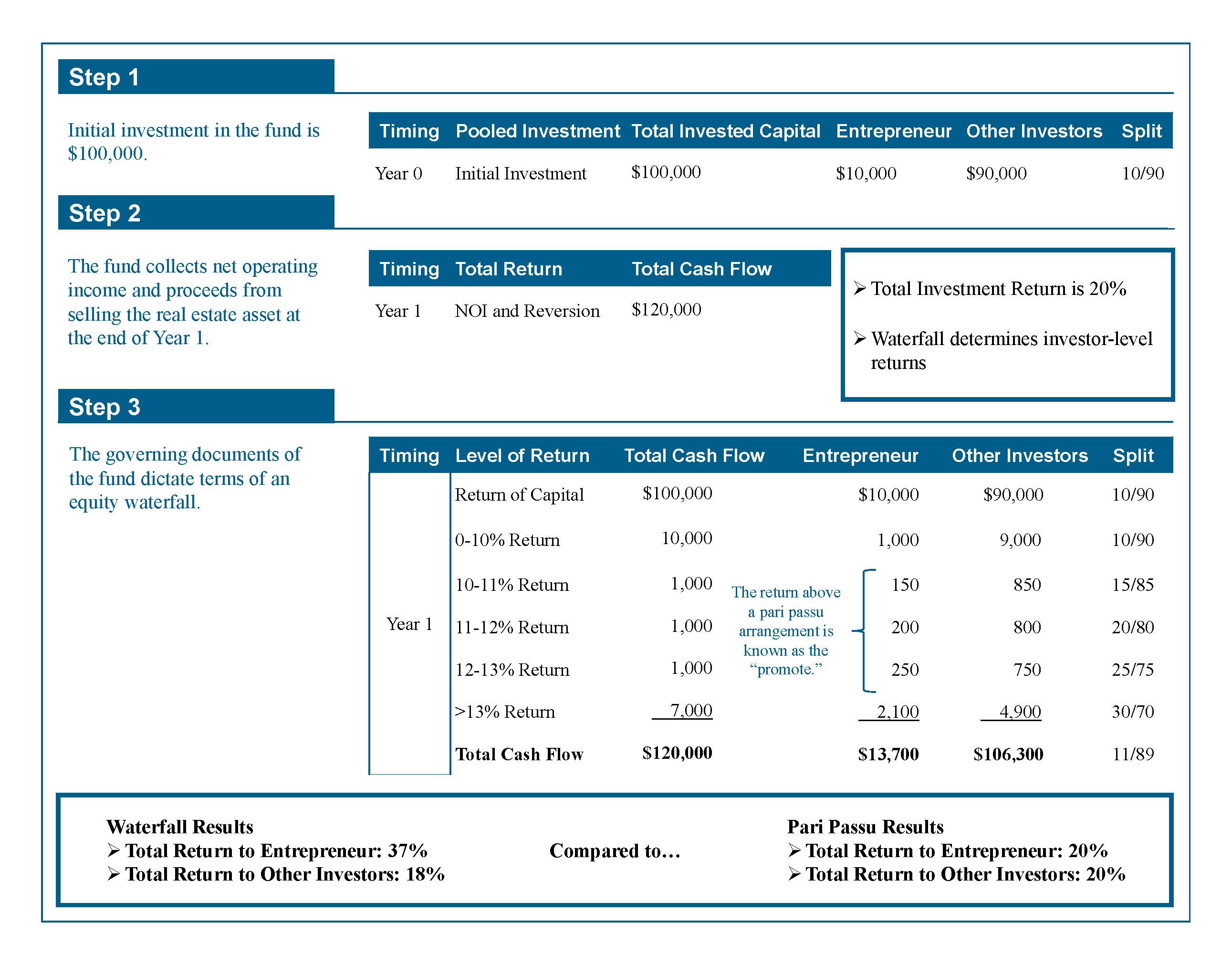

Each equity waterfall can be different; however, the main idea is to decide which partner(s) control the everyday operations of the deal and how distributions are made to the different equity classes. Oftentimes these funds are structured as partnerships with one general partner and many limited partners. Unlike entities that distribute capital on a pro rata (also known as pari passu) basis according to what portion of the initial investment each investor contributed, waterfalls distribute capital by splitting distributions unevenly among partners after certain performance milestones, known as hurdles, are met.

But why would investors agree to receive a distribution that is not proportionate to their initial investment? The rationale is that entrepreneurs bring ideas and investors bring capital. As such, each partner needs to be compensated for what they bring to the table and the relative risk they bear. When capital markets are flowing and good deals are sparse, organizational structures skew to provide a higher reward to the entrepreneur. Alternatively, if capital markets are tight and deals are plentiful, organizational structures skew to favor the “money” investors. Furthermore, a waterfall structure incentivizes the general partner to achieve higher rates of return because at each higher rate of return, the general partner receives a disproportionately higher percent of the distributions compared to the limited partners. Lastly, oftentimes the entrepreneur bears most of the up-front costs associated with real estate development or investment; as such, they must be compensated for this higher level of risk.

Following is a comparison of a typical waterfall structure to a pari passu structure:

Most waterfall models follow the same general principals; however, organizational documents can specify different arrangements that materially impact management decisions and distributions. Although entity management and distribution allocations are the key differentiators, an infinite number of provisions in the organizational documents can impact value. For example, there may be a general partner or managing member that controls the entity and receives separate returns; other times there are equally divided interests, each with management voting rights. In another arrangement, some equity partners are entitled to a “guaranteed” preferred return over other equity partners. Furthermore, members, partners, or shareholders could be individuals, LLCs, partnerships, or corporations, and these subsidiary entities could have an equally complex structure.

Following are a few additional differentiators among waterfall agreements and why they might matter:

The provision. Distributions based on individual investments versus aggregate investments.

→ The impact. If a fund has one investment that performs extremely well, crossing the highest hurdle, but the other investments are a “bust,” the general partner may receive an excessive return on the successful investment, and there may be no returns to any partners on the other investments.

The provision. A clawback provision.

→ The impact. If a fund does not perform consistently over time, historical distributions made to a general partner can be clawed back and redistributed to limited partners.

The provision. General partner in both the voting and nonvoting equity pools.

→ The impact. Whether the entrepreneur is in the deal as a common equity investor and/or a controlling investor entitled to the promote will determine how the equity splits flow.

The provision. The waterfall difference between operating cash flow and reversion cash flow.

→ The impact. If the waterfall specific to operating cash flow favors the general partner as compared to the waterfall specific to reversion cash flow, this incentivizes the manager to hold investments instead of selling.

It is important to understand the governance of an organization with an equity waterfall distribution to fully understand the potential upside and downside of investments. Additionally, to better understand what cash flows to the entrepreneur, investors should consider the additional fees to entrepreneurs that hit the income statement and are not considered equity distributions.

Real estate private equity has championed the use of waterfall structures for operating and reversion distributions. Although the intent of the waterfall organizational structure is good, the complexity of the structure begs the question—is it necessary? For those who do not run the numbers daily on these types of funds or do not have years of experience with this asset class, the structure of these pooled investment funds can seem overly complex. Some critics argue that this structure falls into the category of the exact opaque financial practices that gave way to the Great Recession. Of course, with any partnership structure, the fiduciary is trusted to make value creating decisions for all partners, and it is possible to exploit investors that do not have specialized knowledge of real estate finance. However, the waterfall structure alone is not problematic—sure, it may create additional work for accountants and appraisers—yet many argue that this structure efficiently allocates risk and demonstrates an evolving sophistication in the industry. Time will tell if investors demand simplified organizational structures for the sake of transparency.