Frequently Asked Questions on Tax Increment Financing (TIF)

By Heather M. Burns

Shenehon Company often works with clients in the early stages of real estate development projects to navigate the options available and determine the best way to set the groundwork for a successful project. One financing tool that can be utilized, but is not always fully understood, is tax increment financing (TIF). Based on our experience, we put together a list of frequently asked TIF questions to shed some light on many of the components considered in the TIF process.

Why use TIF?

TIF can be used in real estate development projects when extraordinary costs result in project expenses that are higher than project financing sources plus equity, which produces a return that is either negative or so low that a market-driven project would not occur. Extraordinary costs may include anything from challenging soil conditions to excessive blight. TIF can provide an additional financing source in these cases to cover the gap, which enables a market-driven project to go forward.

How does TIF work?

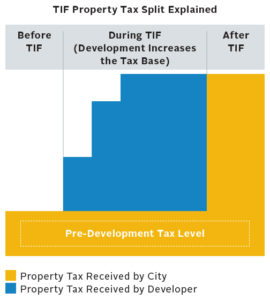

In order to enable the development of a blighted area, or incentivize affordable housing or economic development, a city or authority is sometimes willing to negotiate tax increment financing with the developer. Essentially, the city or authority promises their share of future property taxes (over and above the current pre-development tax level) back to the developer for a period of time (up to 26 years depending on the type of district) as a form of project financing. Through proper use of TIF, the developer gains additional financing needed to complete the project, the city or authority keeps the current level of pre-development taxes and receives a portion of the tax increment (or tax increase) for administrative costs throughout the TIF period, and the city or authority receives the full higher tax level once the TIF ends. The TIF ends either when district term expires or is decertified early due to repayment of all TIF-eligible costs.

What is the But-For Test?

What is the But-For Test?

In order to establish a TIF district, the local government must determine that the development wouldn’t occur without TIF in the reasonably foreseeable future, and that the subject development produces a market value (after subtracting TIF assistance) that will be higher than what would occur on the property without TIF. This process is called the “But-For Test.”

What is the difference between the Project Area and the TIF District?

The Project Area is the larger footprint where TIF money can be spent, whereas the same or smaller footprint (of Property IDs) delineates the TIF District or properties that will generate the property taxes and TIF increment.

What is the difference between Pay-Go TIF and Bonds?

What is the difference between Pay-Go TIF and Bonds?

In Pay-As-You-Go TIF (or Pay-Go TIF), the developer pays for upfront development cost and is reimbursed for TIF-eligible costs twice annually as the increment becomes available (when the tax base increases). In Pay-Go TIF, the developer gets paid pack more slowly over time and carries the risk that the increment generated over the course of the TIF district term may not be enough to cover the total eligible costs. When general obligation tax increment bonds are issued to finance eligible development costs, the developer receives the money upfront, and the bonds are secured by both pledged tax increment (tax increase) and by issuing the municipality’s full faith and credit. There is limited availability for bonds as municipalities are frequently unwilling to secure development activities in case they have to come up with any shortfall.

How can TIF increment be used?

TIF increment can be used to reimburse the developer for TIF-eligible costs such as land/building acquisition, demolition and relocation, environmental/geotechnical studies and correction, site improvements (clearance, earthwork, etc.), public improvements (sidewalks, streets, utilities), parking ramps and lots, TIF administrative costs/professional fees, and paying debt (principal and interest) for the previously listed items. TIF-eligible costs vary for each project depending on the type of district and statutory limitations, terms negotiated between the developer and the municipality, and sometimes include items like buildings (in the case of housing districts) and building rehabilitation/historic preservation.

When is tax increment generated and received?

When tax increment financing is negotiated and put into place, the original net tax capacity of the property is established (based on the city/municipality’s share of the property taxes on the original assessed value of the property). The developer begins constructing the development project and submits the TIF-eligible costs for Year One to the city/municipality. In January of Year Two, the assessor calculates the market value of the property for taxes payable in Year Three. In Year Three, the full property taxes are paid by the developer and the difference between the original net tax capacity (pre-development) and the net tax capacity paid for Year Three is the tax increment paid to the developer (in Pay-Go TIF). These tax increment payments occur twice each year following receipt of property taxes and continue until either all the TIF-eligible costs are repaid or the term of the district expires, whichever comes first. We also note that during the original TIF negotiation, the developer can elect when to receive the first year of increment (which can be up to four years after the district is certified to account for the lag project timing).

What is the five-year rule?

TIF-eligible costs to be submitted by the developer for reimbursement with tax increment must occur within the first five years after the district is certified (per Minnesota Statutes).

The items discussed above summarize many of the important issues our clients encounter when contemplating and negotiating tax increment financing. Please feel free to contact Robert Strachota (612.333-6533 or value@shenehon.com) or Heather Burns (612.767.9448 or hburns@shenehon.com) at Shenehon Company if you are interested in having us consult with you on a particular project and would like to discuss the subjects above in greater detail.