By Joshua Johnson

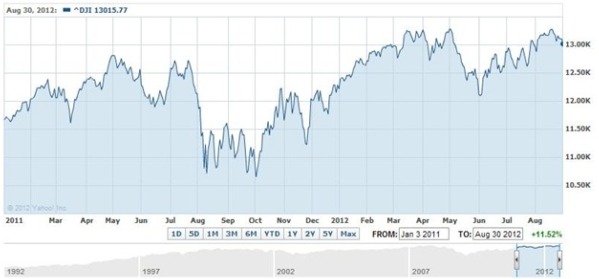

Even the most casual observer of the markets cannot help but notice that the Dow Jones Industrial Average (DIJA or the Dow), experienced an overall increase between 2011 and August 2012. Although a few setbacks occurred, particularly in summer 2011 amid talks of the European debt crisis, the Dow has generally trended upwards. Increasing from roughly 11,500 in early 2011 to the present 13,000, the Dow experienced an approximate 11.5% gain over that time period.

A number of groups have publicly expressed their opinions of where the Dow is headed. Most predictions fall into one of two categories. In one camp are the ever-indomitable bulls, who believe the markets are getting ready for continued upward growth as evidenced by improving corporate profits. On the other hand, there are the bears who tout current employment and personal income figures as evidence that continued growth will be difficult to sustain. While there is evidence to support both hypotheses, only time will tell which way the Dow will go.

Relevant analysis is one of the key elements of a top-notch business valuation. This is especially true in times of economic instability. Valuation experts, such as those at Shenehon Company, constantly analyze companies, industries, and the economy to develop a sense of which way the pendulum will swing.

STAY IN THE LOOP

Subscribe to our newsletter.

Explore More