By Andrew T. Donahue

Walgreen Co. v. City of Madison

On July 8, 2008, the Wisconsin Supreme Court reversed a 2007 Wisconsin Court of Appeals decision and remanded it for further proceedings. In the case of Walgreen Co. v. City of Madison, at issue are the 2003 and 2004 assessed values for two Walgreens properties in Madison, Wisconsin. Walgreens leased the properties from the developer and was also responsible for the property taxes. As is typical with Walgreens’ projects, the developer constructed the properties according to Walgreen Co. specifications, including certain above-market features (super-adequacies). The developer was paid a rent higher than the market rent to cover costs relating to financing, land acquisition, construction, development, and a reasonable developer’s profit. The City’s appraiser based the appraised value on the actual contract rent while Walgreens’ appraiser relied on market rent to determine value. Although the two sides disagreed on several other points, ultimately the case hinged on whether it is proper to use market rent or contract (actual) rent as the basis for determining assessed value.

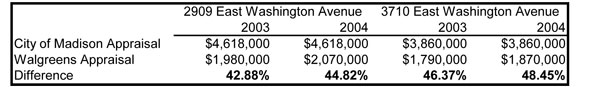

As expected, concluded values in the Walgreens appraisals differed substantially from those reported in the City’s appraisals. Walgreen Co. appealed the assessed values for 2003 and 2004 to the City of Madison Board of Review without success. It subsequently appealed to the Dane County Circuit Court and the Wisconsin Circuit Court losing each time. Finally, Walgreen Co. took the case to the Wisconsin Supreme Court which reversed the previous decisions.

Methodology

Walgreens argued that the proper methodology, as outlined in the Wisconsin Property Assessment Manual (Manual), is to use market rents to determine fee simple interest. The City argued that the actual contract rents – which were above market rents – should be used in order to determine the full value of the property. The following chart shows the values concluded by the City and Walgreen for the subject properties.

The Court reminded the appraisers that “the power to determine the appropriate methodology for valuing property for taxation purposes lies with the legislature” and that “he goal of the assessor is to estimate the market value of a full interest in the property, subject only to governmental restrictions. All the rights, privileges, and benefits of the real estate are included in this value…also called the market value of a fee simple interest in the property” (¶20 of 2008WI80).

The parties agreed that the income approach to value was the most appropriate method for estimating the market value of the properties. The Court concurred and further clarified the use of the income approach with this quote from the Wisconsin Property Assessment Manual: “hen applying the income approach, the assessor must use the market rent, not the contract rent, of the property (unless valuing federally subsidized housing…)”

The Court emphasized the Manual definition of market rent as: “rent that a property would receive based on the current, arm’s-length rent commanded by similar properties in the marketplace.” It also drew attention to the fact that the value of real property for assessment purposes is based on estimating the market value of a fee simple interest. The Manual requires that market rent be used when determining the fee simple interest of leased retail property. When contract rent is used, the resulting value calculation is that of a leased fee interest, not a fee simple interest. Describing the methodology of the two appraisals, the Circuit Court noted that ” appraised the fee simple interest in the two properties without consideration of the lease, while appraised the leased fee interest” (¶10).

Why the City selected non-market rents

The City argued that it was justified in using contract (actual) rents, as opposed to market rents, for the two Walgreens properties because the Manual is in conflict with Wisconsin’s statutory requirements on this issue. The City claimed that the Manual’s methodology violates the Wisconsin Statute 70.32(1) requirement that property be assessed based on the full value that could be obtained at a private sale. The statute refers to full value as the lease’s value within the scope of the rights or privileges pertaining to real estate defined under Wisconsin Statute 70.03’s definition of real property. Thus, the City’s interpretation is that contract rents provide the proper basis for assessing full value (¶30 of 2008WI80). The City relied on three cases to justify its use of contract rents: Metropolitan Holding, Darcel, and West Bend.

The Court rejected these cases as supporting evidence because they address how to value properties operating with below market rent contracts. In each of the above situations, the Court allowed limited exceptions to the general rule recognized by the Manual (7-4 to 7-5), because a potential purchaser “would be unable to obtain the market rate value of property due to a lease encumbrance” (¶37).

The City also cited a public housing case to further support its claim. However, the Court responded by again pointing to the Manual’s requirement that “assessors must value property based on the market rent rather than the contract rent leased property ‘unless valuing federally subsidized housing'” Property Assessment Manual 7-29 (¶38).

When it is appropriate to apply a non-market rent

The appropriate time to use non-market contract rents is when they are below market levels. The Manual allows this exception because a buyer could not obtain the fair market value at sale, thus the property should not be valued as if obtaining fair market value were possible. The Court defined a property with a below market rent as being “encumbered” and a property with an above market rent as “enhanced”. The Court also cited the Appraisal of Real Estate 12th Addition, which states: “

lease never increases the market value of real property rights to the fee simple estate.”

As it relates to Walgreen Co. v. City of Madison, the Court pointed out that there is no exception in the Manual which allows for the appraiser to increase the market value of a property based on above market lease rates. In contrast to the property encumbered by below market rents for which the buyer is unlikely to receive market rents, existing above market rents do not prevent the buyer from receiving, at a minimum, market rental rates.

Unusual Financing Arrangements

The parties agreed that including development costs in the rent results in what the Circuit Court described as “higher than normal” lease rates. As mentioned earlier, the subject properties were constructed in a manner that followed Walgreens’ business model – the developer constructs the property which Walgreens then rents (¶6 WI 2008 80). Thus, they enter into a lease that encompasses the real estate costs as well as prior efforts and financial expenses borne by the developer. Furthermore, Walgreens agreed that the “higher than normal” lease rates would increase the value of its stores to potential purchasers, but stressed that the rent would still be based partly on real estate value and partly on contract value: the contract value is represented in the lease payments by the amount of rent paid above market rental rates.

Walgreens argued that using such a lease is not allowed since it relies on unusual financial arrangements and cited Flood and Flint . While these two cases relate to sales and not leases, they address the same underlying principle which states that “a real property assessment should not be based on factors such as unusual financing or above market rent that are not normal conditions of sale reflected in the value of a fee simple property interest.” The Court agreed with Walgreens stating: “These cases establish that unique financing arrangements are not part of the ordinary conditions in the market establishing “full value” within the meaning of Wis. Stat. § 70.32(1).” In relating this to the current case, the Court concluded “that tax assessors must refrain from including creative financing arrangements under a specific property’s lease in their valuations of that property.”

The City also argued that there were prior cases – ABKA, Waste Mgmt., and N/S Associates – in which the courts held that, under the income approach, a property’s business value or income-producing capacity that is “inextricably intertwined” with the property may be considered among those “rights and privileges” of the property. The Court did not accept these cases as evidence stating the City failed to establish that an “inextricably intertwined” situation existed. In all three cases, the courts determined the value was attributable to the underlying real estate. The Court also pointed to Adams and said that in order for the “principle to apply, that all of the value it assigned to Walgreens’ retail properties related ‘primarily to the nature of’ the real property itself’, as opposed to being attributable to the labor, skill, or business acumen of the developer, Walgreens, or other factors.”

The Court continued: “f we were to expand the law in the direction the City requests, property assessments would in essence become business value assessments, with assessors improperly equating financial arrangements with property value. This is in contravention of the general principle that real property assessments should not be based on business value” (¶65) and “it is also bad policy to do so in the manner the City assessor did in this case, in effect taxing business efforts instead of the property”(¶34).

Summary

The Court essentially defined the role of the assessor as one who applies only market data, unless there is substantiated conflict between the Manual and statutory requirements – or in the case of below market rents. Moreover, and specific to this case and income producing property in general, it is the assessor’s duty to use market rent for the purposes of determining full (fee simple) market value. This case has placed Wisconsin in agreement with most other jurisdictions throughout the nation. There are several valuable points for appraisers, attorneys, property owners and tenants of retail, or other income producing properties to consider:

- In uncertain economic times such as these, many previously determined rents may end up being above market. This is significant because the current market value should reflect the current market rents available.

- When a rental rate is below market and the property owner isn’t able to obtain market rents, the property’s assessed market value should reflect the situation.

- The values will be equal only when the contract rents are equivalent to the market rents.

- A lease’s rent is an encumbrance of the bundle of rights rather than a “right and privilege” of the bundle of rights.

STAY IN THE LOOP

Subscribe to our newsletter.

Explore More