File Nos. 70-CV-07-9031; 70-CV-07-9041

Tax appeals provide property owners with the opportunity to show that the subject’s assessed value is not in line with the values of similar properties. The burden of proof is on the petitioner who must present a solid appraisal supporting the case for reduced property taxes. To determine market value, the appraiser must first consider: the nature and history of the subject property, local zoning ordinances, market conditions, conditional use permits and the highest and best use of the subject and then analyze the subject using the three approaches to value: cost, market and income. In the analysis section of the report, the appraiser discloses assumptions, states the facts and describes adjustments in great detail. It is up to the judge to decide which expert has the most credible, persuasive appraisal based on the evidence presented. The Courts expect the appraisal report to reveal and support the appraiser’s line of reasoning. Although the Court allows direct testimony, the report is tantamount to the actual testimony.

In 200 Levee Drive LLLP v. County of Scott, the findings of fact regarding the property are straightforward. The subject is a 66-bed subsidized senior housing facility (with a legal conditional use permit), operating in Shakopee, MN. The facility is of good quality, an asset to the community and an income-producing property. The County Assessor agreed with the findings of fact and valued the subject accordingly. The Taxpayer disagreed with the highest and best use (HBU) as senior housing, arguing that it should be valued as an unrestricted living facility rather than non-subsidized senior housing. Additionally, he argued that it was a non-conforming use due to inadequate parking. No credible evidence supporting his opinions was introduced, and the Court agreed with the County Assessor that:

- the facility operates with a legal conditional use permit

- the facility has adequate parking for its current use and additional land could be made available on site for expansion of parking if needed

- the HBU is senior housing

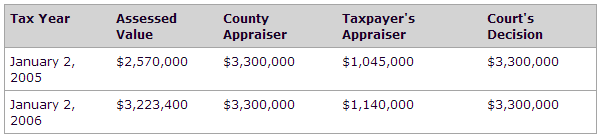

- the market value for the years in question (2005 and 2006) is $3,300,000 as decided by the Court. Each party’s position is shown in Exhibit I.

Exhibit I

Each expert relied on the income and sales approaches to arrive at a value. Due to the age of the improvement, the cost approach was not used. Subsidized housing, according to case law, must first be valued as if it were general, unrestricted housing using market rent comparables. The comparables are subsequently adjusted to account for rental restrictions; differences in age, quality, size and location; rate of risk, net operating income and so on. Although the experts used the same methods, they disagreed significantly in their analyses and value conclusions.

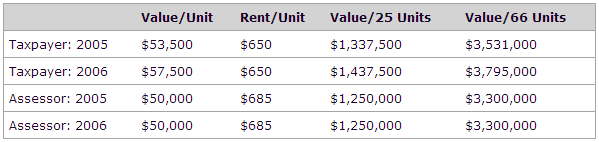

Exhibit II

The Taxpayer’s expert presented no compelling evidence to support his assumption that 61% of the facility was non-conforming and should not be included in the assessed value. The judge determined that no zoning violations existed and ruled in favor of the County Assessor in all instances. As indicated, in Exhibit II, one of the most interesting aspects of this case is that despite using different comparables, market rents, cap rates and adjustments, the concluded per unit values and market rents were not that far apart. The difference was due to the fact that the County’s appraiser based his analysis on all 66 existing units, while the Taxpayer’s appraiser based his value on only the number of units for which he opined there was adequate parking: 25 units. His entire case hinged upon the Court’s acceptance of his assumption that 41 units were non-conforming and, therefore, not subject to property taxes.

This case clearly speaks, once again, to the fact that the burden of proof is on the taxpayer. Ironically, the assessed value of the subject property was increased for both 2005 and 2006 as a result of the evidence presented. Appraisals destined for use in Tax Court must be well-documented yet simplistic enough to convey the appraiser’s reasoning to the Court. Either the Tax Court is ruling more frequently in the government’s favor or the Taxpayer and/or his appraiser relied on a flawed analysis. According to the Court, a compounding of small errors, misguided thinking and unsupportable assumptions left the Taxpayer out of the competition. Upon review, the facts spoke for themselves, and the judge ruled accordingly.

A copy of the case is attached. We invite you to read it carefully and come to your own conclusions. It is an excellent example of how difficult it is to prevail in a tax appeal, and it indicates how high the bar has been raised to be successful in this type of litigation.

STAY IN THE LOOP

Subscribe to our newsletter.

Explore More