Valuation Viewpoint Newsletter Volume 13, Number 2 fall 2008

Appraising residential property is similar to appraising commercial property; the objective is to estimate the market value of the fee simple interest of the subject real estate. Relying on research of comparable sales, an understanding of the market and past experience with single-family residential properties, the appraiser employs three valuation techniques to conclude a value range. Before we address the challenges of valuing a luxury home, it is helpful to first identify the sub-markets of single family residential properties and define the three approaches to value.

Single-family residential products fall into several categories, each with its own characteristics and markets. The first group consists of condominiums and town homes. They have fairly standard building features, are located in a variety of neighborhood types, are available in a large price range, and have an extensive buyer market. A second type of residential unit is the single-family home which includes low-cost, no frills models as well as homes in the average price categories. Despite differences in location, cost, style, and amenities, they are considered similar products with broad appeal and a large buyer market. The third sub-group is comprised of above-average single family homes with over-sized lots, increased square footage, and custom features. The prices for these homes are higher than normal and the buyer market more limited. Finally, the smallest sub-set of single-family homes is the luxury home group: unusually large, customized homes in prime locations, constructed of the finest materials with a limited buyer market.

“Finally, the smallest sub-set of single family homes is the luxury home group: unusually large, customized homes in prime locations, constructed of the finest materials with a limited buyer market. ”

The prices for these homes are higher than normal and the buyer market more limited. Finally, the smallest sub-set of single-family homes is the luxury home group: unusually large, customized homes in prime locations, constructed of the finest materials with a limited buyer market. An appraisal is composed of several integrated and interrelated procedures that have a common objective—to arrive at an accurate estimate of value. For our purposes, value is defined as the amount a willing buyer would pay a willing seller for the subject property. The appraiser relies on three basic techniques when valuing real property: the cost approach, the sales comparison approach, and the income approach. The cost approach allows the appraiser to establish market value based on the costs to build a similar structure in the current market. In the sales comparison approach, the appraiser gathers data from similar sales and adjusts them for differences in size, location, and time on the market to arrive at a range of value for the subject. Finally, appraisers rely on the income approach to determine value based on a property’s income-producing potential.

An appraisal is composed of several integrated and interrelated procedures that have a common objective—to arrive at an accurate estimate of value. For our purposes, value is defined as the amount a willing buyer would pay a willing seller for the subject property. The appraiser relies on three basic techniques when valuing real property: the cost approach, the sales comparison approach, and the income approach. The cost approach allows the appraiser to establish market value based on the costs to build a similar structure in the current market. In the sales comparison approach, the appraiser gathers data from similar sales and adjusts them for differences in size, location, and time on the market to arrive at a range of value for the subject. Finally, appraisers rely on the income approach to determine value based on a property’s income-producing potential. The income approach is enerally not relevant when valuing single family homes as they are not typically income producing properties. The three approaches to value are seldom completely independent and each has its own strengths and weaknesses. Depending upon his or her analysis of the available data, the appraiser may choose to place greater emphasis on a particular approach when arriving at a value, as is often the case when dealing with unusual properties, such as luxury homes.

“The appraiser may choose to place greater emphasis on a particular approach when arriving at a value, as is often the case when dealing with unusual properties, such as luxury homes.”

Appraising a luxury home is far different from appraising a standard single-family residential home: the buyers and sellers are not typical, the properties are unique, and comparable sales are more difficult to find. The luxury home market is quite small, generally consisting of three buyer categories: ultra wealthy individuals, the institutional buyer (a university may desire an entertainment facility or a residence for its president) or the service industry buyer (an investor may convert an old mansion into a banquet or reception hall for public rental). The most common buyer is the wealthy individual who wants to build or buy a dream home. A luxury home is the owner’s personal statement: expressing success, uniqueness, taste, and style. It is most often custom-built, requiring substantial financial resources to design and construct. At the local level, both the buyer market and comparable sales are likely to be quite limited— so much so that the appraiser may expand the search for comparable properties and potential buyers to regional and national as well as international markets.

Several criteria identify luxury residential properties, distinguishing them from large, attractive, above-average, single-family homes. Lots for luxury homes are much larger than those for typical homes and typically have views of lakes, ponds, hills in addition to other highly desirable landscape features. In the Twin Cities, luxury homes are often constructed on sites with Lake Minnetonka frontage, along prestigious streets like Summit Avenue or Mississippi River Boulevard and around the Minneapolis lakes. They generally exceed 5,000 square feet in size and boast a variety of features and amenities not found in regular homes. Among the more common are: a guest house, caretaker’s cottage, tennis court, swimming pool and cabana, theater, wine cellar, library, helicopter landing pad, multiple garages, and an elevator. Owners often specify ornate finishes; large formal staircases; volume ceilings; commercially equipped entertainment kitchens; ironwork; and expensive, imported wood and stone. Luxury homes are generally equipped with state-of-the-art security systems which feature cameras, room sensors and security gates. One finds attention to detail without regard to cost—no expense is spared in design, materials, and features when constructing a home of this caliber. Likewise, when the ultra-wealthy purchase an existing home, they often spend large sums remodeling the home to accurately reflect themselves with unique rooms, designs, materials, and finishes.

unique features of some luxury homes

The more unique and luxurious a home is, the greater the disparity between its market value and the cost to build it. The ultra-wealthy are not interested in buying someone else’s dream when they can afford to build their own. Owners frequently sacrifice resale value in favor of personalized and expensive design features and materials. If and when a luxury home sells, it is likely that it will be extensively remodeled, if not demolished, by the buyer. Because each luxury home is built specifically to the owner’s tastes, the market is limited and there are few, if any, comparable sales to use as benchmarks for value.

“The more unique and luxurious a home is, the greater the disparity between its market value and the cost to build it.”

As mentioned earlier, the appraiser begins the valuation process by applying the traditional approaches to value: the cost approach, the sales comparison approach and the income approach. The cost approach is not the most appropriate measure of value for luxury homes because the cost to build a luxury home does equal its market value. There are redundancies as well as overimprovements in luxury homes that skew the actual building costs. For example, during the construction phase, the owners may decide that they do not like the location of the grand staircase—the builders must remove it and rebuild it. While the actual cost of constructing the grand staircase doubles, market value considers only the cost to build it once. Determining reproduction or replacement costs is also difficult because of the custom nature of the finishes. As the cost and uniqueness of a luxury home increase, this approach becomes less reliable and less effective.

The sales comparison approach is the primary method for estimating market value for single family luxury houses, institutional, and service industry homes. The appraiser evaluates recent sales of properties that have equivalent types of amenities, finishes, lot sizes, locations, etc. The appraiser also considers depreciation: physical, functional, and location-related. One expects very little physical depreciation in luxury homes as they are generally very well maintained. Functional depreciation in a luxury home is generally due to over-improvements. A home owned by a singer or producer, for example, may feature a recording studio. Although valuable to the current owner, it is of little importance to a potential buyer. The appraiser will discount the overall value of the property for functional depreciation based on the over-improvement. Locationrelated depreciation addresses the prestige of the property’s location and accessibility. A luxury home constructed in a remote, wooded location may have sentimental value for its current owner, but such emotional ties will not have the same value for the next owner. Sentimental value does not increase resale price nor does it enhance the pool of buyers. On the contrary, a luxury home built on Lake Minnetonka is easily accessed and within commuting distance of a large metropolitan area, giving it increased location-related prestige. The luxury home located in a remote location requires a substantial downward adjustment compared to a home located on Lake Minnetonka. In the final analysis, luxury homes, similar to office buildings, are valued on a per square foot basis. Since a prudent buyer will not pay more for a specific property than for an equally desirable substitute property (the principle of substitution), when adequate data is available, the sales comparison approach provides the

strongest indication of value.

“The sales comparison approach is the primary method for estimating market value for single family luxury houses, institutional and service industry homes.”

The income approach is most useful for valuing investment or income producing properties: a service industry home that is rented out for public use, for example. As such, it does not apply to single family luxury residential properties.strongest indication of value.

“In contrast to commercial and regular residential real estate markets, historically, the luxury home market has not been bound by rational price movements.”

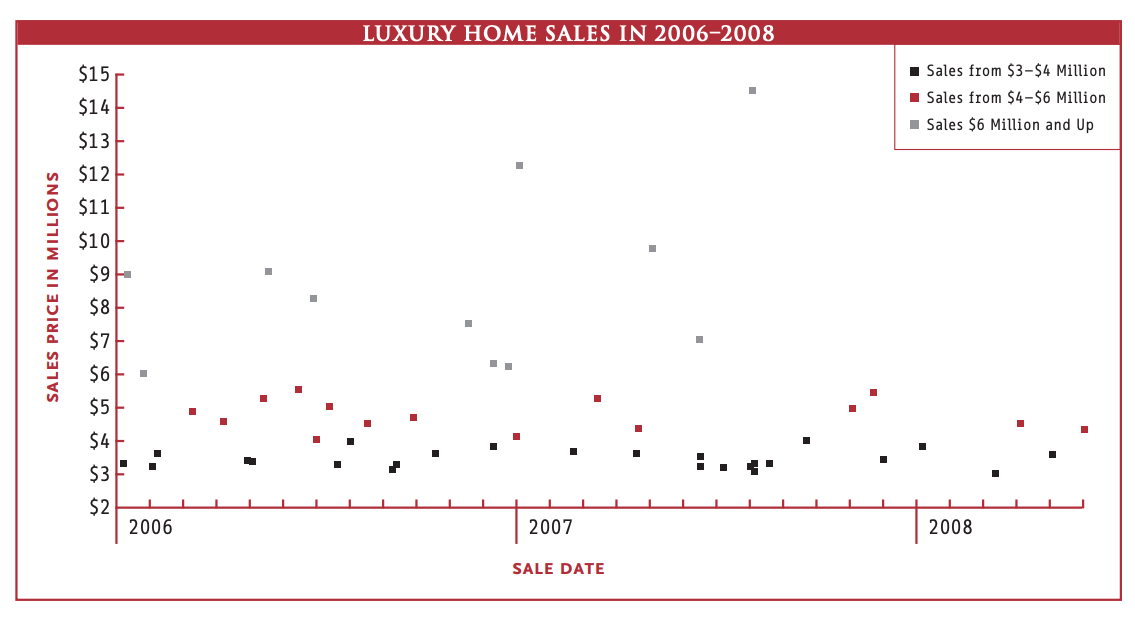

In contrast to commercial and regular residential real estate markets, historically, the luxury home market has not been bound by rational price movements. Our experience with this upper-end market shows that sale prices escalated in the 1990s, though not on a straightline basis. Prior to 1990, a one million dollar sale price was a rare, even on Lake Minnetonka. In the past decade the number of houses selling above this price range has skyrocketed. Since 1996, there have been numerous documented singlefamily home sales over two million dollars in the Twin Cites. Additionally, luxury home sales well above five million dollars are not unusual. Based on studies of sale data, it seems that a price plateau, defining the upper limit of values for luxury homes, is established every 12 to 18 months. This price plateau remains effective until a distinguishing sale of significantly higher price occurs and establishes a new marketplace “standard”. Occasionally, a sale will occur at a slightly higher level than the current plateau—these sales are essentially outliers and do not establish higher levels across the market. A new price plateau is established when one sale is followed by a significant number of subsequent sales at higher levels than previously seen. The sale which raises the price standard in the marketplace is not necessarily the best house on the market. Each cycle, the benchmark sale price is higher than the last.

The current price plateau is roughly $6,000,000–$8,000,000, though it is likely that a new ceiling will be established in the near future. As the graph indicates, 2006 saw a high sale of $9,050,000 and 2007 saw a high sale of $14,500,000. To date, 2008 has a high sale of $4,500,000. Although there have been several sales in excess of $3,000,000 so far in 2008, there are dozens of luxury homes currently listed for sale. As a result of the overall stale residential market, luxury home sales have slowed. Given past price activity and assuming that the weak economy continues, it is our projection that a new price plateau will be established in the first half of 2009.

The luxury home market is characterized by very large, individualized homes, constructed of the finest materials. These same characteristics make appraising luxury homes much more complex than appraising standard single-family residential properties. Because each property is unique, comparable sales are scarce and the buyer market limited. Although cost is not a factor when buyers pursue their dream homes, the luxury residential market is not immune to the weak economy. Despite the fact that prices have not dropped, sales have slowed in 2008.

STAY IN THE LOOP

Subscribe to our newsletter.

Explore More