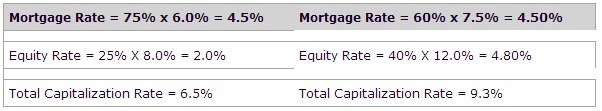

Appraisers are frequently asked where “cap rates” are heading – another way of asking whether values are going up or down. The capitalization rate (cap rate) is the ratio of net operating income to property price. It determines the return on investments. Fluctuating cap rates have a significant impact on property values. The capitalization rate is a weighted average comprised of the mortgage rate and the equity yield rate; a change in either variable impacts the overall rate. With the capital markets in disarray, buyers fortunate enough to secure financing are finding that bank lending requirements are more stringent than in the past. Higher mortgage rates and shorter amortization terms have raised the loan constant. Additionally, lenders changed the weighted average of the cap rate by requiring more equity from the borrower which is at a higher rate compared to the mortgage rate. Investors are looking for higher risk premiums compared to prior years. Below are two examples showing the impact of the change in the mortgage rate (mortgage constant), amount of equity required, and the higher yield rate:

To determine the appropriate cap rate, appraisers rely on sales of similar properties for support, however the number of sales in today’s environment is low for several reasons. First there is a gap in pricing between what the seller perceives the property is worth and what the buyer is willing to pay – buyers and sellers have radically different perceptions of values in the current market. Appraisers also depend on Information provided by investment brokers in local markets as to the direction of capitalization rates. In their listings of Class A and B quality properties, investment brokers have found that prospective buyers have increased their cap rates 150 to 250 basis points higher than those of one year ago. The increase in the capitalization rate was most pronounced after the September/October 2008 credit meltdown when financing suddenly became more difficult to secure.

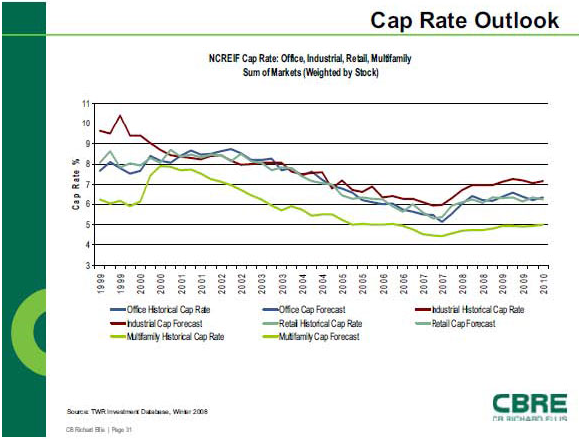

Investment brokers cited examples of listings in which the asking prices were lower due to the higher cap rates. One office building, originally listed with a capitalization rate of 7.6% in early 2008, posted a cap rate in the low 8% range by the summer of 2008; it is currently listing a cap rate in the low 9% range. Two grocery-anchored centers are listed with cap rates of 9.5%. An industrial building in the suburbs was purchased in 2006 with a long term lease in place at a 7.25% capitalization rate is now being offered, with the same lease, at a cap rate of 9.0-9.5%. Class B office buildings currently being offered in the Twin Cities are in the 9% to 10% cap rate range depending on the length of the leases. Class A property capitalization rates are in the upper half of the 8%s. The chart below offers a historical look at capitalization rates and the anticipated outlook on a national basis.

STAY IN THE LOOP

Subscribe to our newsletter.

Explore More