By Timothy A. Rye

Record levels of residential development occurred from 2000 to the peak of the market in roughly 2006. Financing was readily available and potential buyers, eager to take advantage of low interest rates and unusual mortgage terms, flooded the market. This rapid increase in demand for new homes created a development boom. By 2008, as financing for developers and homebuyers dried up, new home sales fell significantly. Many developers with completed, or nearly completed, projects were able to close sales on their new home inventories. However, for those who purchased large tracts of land with the intent of developing them within 2 to 5 years, the business climate changed drastically. Absent the expected demand for new homes, what was anticipated to be a 2 to 5 year holding period is now likely to be a 15 to 20 year hold with no guarantee that the project will remain feasible.

The market for vacant land considered ripe for development in the near term has evaporated. Small and midsize developers with working capital invested in now-illiquid assets are struggling to survive. We find very little in the way of new construction; city planners and developers have delayed many projects indefinitely. When the holding period for development land increases, the highest and best use of residential land on the fringes of developing communities for the near term changes as well. Consider, for example, the impact of altering the development timeline for two cities in the 13-county metro MN area – Belle Plaine and Spring Lake Township. Each of these communities has experienced falling land values and the loss of development potential due to the recession.

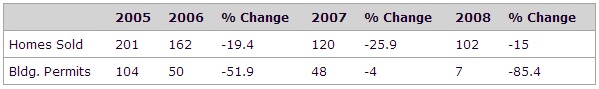

From 2000 to 2008, the population in Belle Plaine increased by 57%, making it a hotspot for residential development in the near term. City planners were poised to move forward with utility and infrastructure upgrades and had approved several residential developments in the area. Residents looked forward to the improvements and the potential for additional revenues. However, as the market fell, so did residential home sales, with the equivalent of a 20% drop in homes sold each year from 2005 to 2008. Building permits also declined at an alarming rate during the same period which was even more worrisome for developers. The following table summarizes sales and building permits for the City of Belle Plaine, MN from 2005 – 2008.

These numbers clearly illustrate the sharp reduction in demand for housing. In the 4 or 5 years preceding the recession, land available for residential development was highly prized; it was a seller’s market and land values continued to rise. Recently, however, many people who anticipated selling residential land to developers found few buyers and sharply reduced land values. It comes as no surprise that the price per acre of land ripe for development in the near term is much higher than the price per acre of land that may not be ready for 15 to 20 years.

Illustrating further the effect of the drop in demand, we look at the situation in Spring Lake Township just southwest of Prior Lake, MN. A well-known developer purchased 63.5 acres at $50,000 per acre in November of 2005. The developer planned to extend utilities and build out the site within 5 years. When the recession hit, demand fell, the development failed and the property headed for foreclosure. Subsequently, the previous owner approached the developer and offered to buy the property back. The developer sold 33.5 acres to the previous owner for approximately $19,850 per acre, almost 60% less than what the developer had paid for the property three years earlier. The current owner (also the original owner) plans to hold the 33.5 acres for the long-term (likely 20-30 years) and farm it until the property becomes, once again, ripe for development.

Every community is in a different position with regard to its potential for growth and each piece of land is unique. However, statistics indicate that improved properties have suffered a significant loss of value in the last three years. Additionally, losses in demand and financing, and declining values for property in other markets have changed the highest best use for many residentially guided land parcels. At present, the price-per-acre for vacant land has dropped significantly and the holding period has increased dramatically. It is unlikely that the market will correct itself in the immediate future.

STAY IN THE LOOP

Subscribe to our newsletter.

Explore More