Market View Q2 2015

Economic and Real Estate Market Snapshot

Article Highlights:

• U.S. employers added approximately 664,000 jobs in the second quarter of 2015

• 90% of surveyed Minnesota businesses positive about economy

• Activity in the manufacturing sector expanded for the 30th consecutive month

• Economic growth is supporting improvements in the CRE market, but new development activity is accelerating

• Construction spending climbs to the highest level in six years

• Home builders are the most optimistic since 2005

• U.S. office construction activity was up nearly 25.0% from second quarter 2014

• U.S. retail vacancy rates are projected to drop 30 to 50 basis points from one year prior

• Tightening spreads are likely to hold cap rates near historic lows

National Economic Landscape

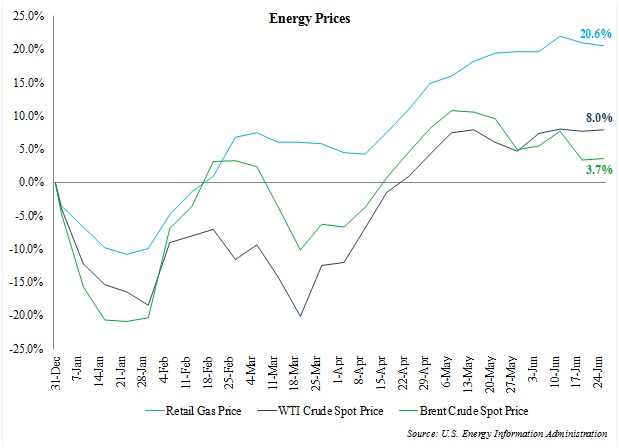

Several headwinds that held back economic growth in the first quarter of the year began to fade going into the summer of 2015, yet new obstacles came to the forefront during the final weeks of the quarter that largely overshadowed progress made in the second quarter. Temporary economic drags in the first quarter of 2015, burned-off going into the second quarter of the year. Meanwhile, concerns about a strengthening dollar and spending cuts in the energy sector began to ease. After a strong performance in the early months of 2015, the dollar rally began to stall and demonstrate signs of weakening in the second quarter, retracing 1.5% from March to June. Meanwhile, the selloff in crude oil also paused in May into June, with NYMEX crude oil futures at the close of the second quarter up approximately 23.0% compared to the end of March. Retail gas prices as well as WTI Crude and Brent Crude spot prices were also up year-to-date at the end of June yet lower compared to year-ago figures. The following graph presents year-to-date retail gas and crude oil spots prices through the second quarter of 2015.

Economy seeing modest or moderate growth

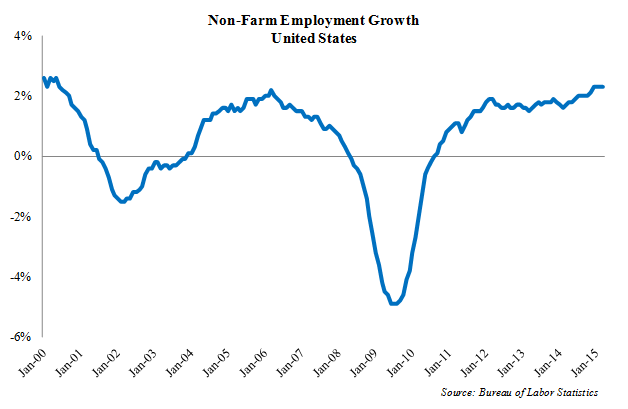

According to the latest Federal Beige Book, seven of twelve Federal Reserve Districts, including the Minneapolis District, reported observing modest or moderate growth into the second quarter of 2015. Outpacing the 1.9% year-over-year increase noted 12 months prior, non-farm employment at the national level increased by 2.1% year-over-year in June of 2015 on the net addition of approximately 664,000 jobs in the second quarter of 2015. Employment gains in the second quarter were largely supported by growth within the professional/business services, education/health services, and financial activities sectors. The following graph presents historical year-over-year national non-farm employment growth.

Construction Spending Climbs to Highest Level in Six Years

The downturn in the oil and gas industry is hampering manufacturing activity, but growth in the construction sector is anticipated to pick up some of the slack in the labor market left by softer energy prices. Led by a combination of both public and private development activity, construction spending advanced by over 2.0% in the second quarter, climbing to the highest level in more than six years. Further, the labor market for skilled construction workers remains tight, as a significant percentage of skilled trade workers exited the construction industry following the housing bust in 2007-2008 and have yet to return, putting upward pressure on wage growth.

Manufacturing Sector Expanded

While the notable slowdown in the oil and gas markets have served as a drag on manufacturing activity, economic activity in the manufacturing sector expanded for the 30th consecutive month in June, with 11 of 18 manufacturing industries reporting growth. According to the latest ISM Report On Business, the manufacturing sector expanded at a slightly faster pace at the close of the second quarter, as the PMI registered 53.5% in June, up from 52.8% in the prior month but down from 55.7% recorded one year prior. Non-manufacturing activity also increased as the ISM Non-Manufacturing Index was recorded at 56.0% in June of 2015, up slightly from 55.7% in May of 2015. Additionally, nine of ten indicators that comprise The Conference Board Leading Economic Index (LEI) were up in May. Increasing to 123.1 in May of 2015, the two largest contributors to the LEI during this period were building permits and the interest rate spread.

U.S Economy Will Continue Growth Pattern

Supported by improvements in the labor market and healthy consumer confidence, economic growth is expected to accelerate in the second half of 2015, with domestic GDP projected to increase in the mid-2.0% to 3.0% range in 2015. Business spending is forecasted to increase by 4.0% during the year, with further growth held back by energy firms tightening their belts. Meanwhile, disposable income is expected to increase in the mid-to-high 3.0% range in 2015, as a tight labor market puts more upward pressure on wages. In sum, the underpinnings for domestic economic expansion are in place.

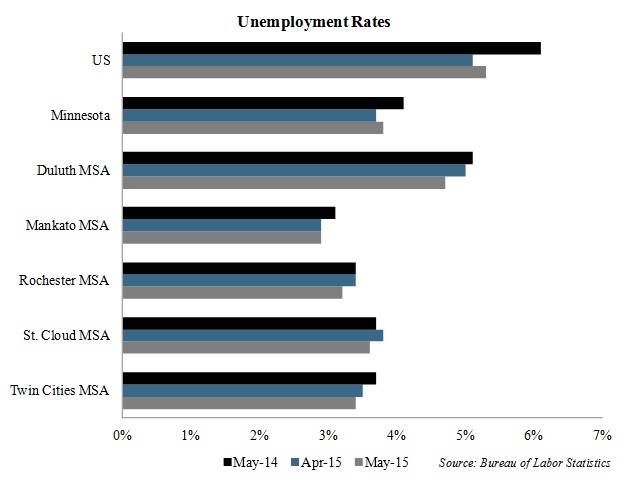

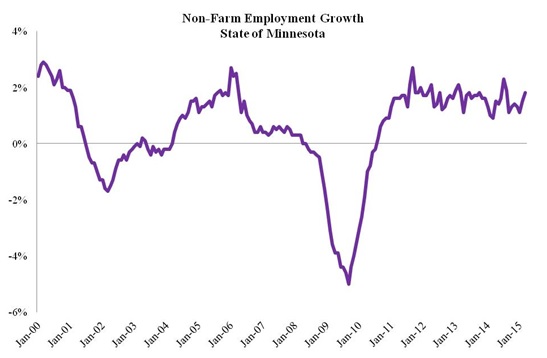

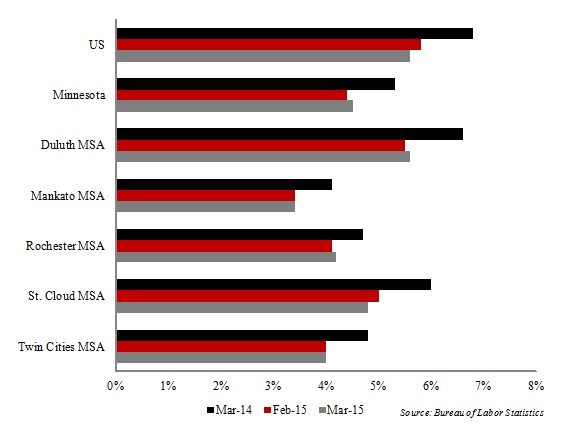

State of the State – Minnesota Employment Strong

Non-farm employment at the statewide level increased by 1.5% year-over-year in May of 2015 on the net addition of approximately 42,600 jobs, as payroll figures statewide increased by roughly 20,500 in the first five months of 2015. The trade/transportation/utilities sector emerged as a growth leader among employment sectors in the second quarter of 2015, but increasing payroll figures were posted across nearly all employment sectors. As a result, the unemployment rate in Minnesota decreased to 3.8% in May of 2015, down 30 basis points from 4.1% reported 12 months prior, though up 10 basis points compared to 3.7% posted in April of 2015. The unemployment rate in Minnesota continues to compare favorably with the national level, which reported a non-seasonally adjusted unemployment rate of 5.3% in May of 2015. Among regional MSA markets in Minnesota, the unemployment rate remains lowest the Mankato area (2.9%), followed by Rochester (3.2%), Twin Cities (3.4%), St. Cloud (3.6%), and Duluth (4.7%). The following chart presents unemployment rates for regional MSA markets, state of Minnesota, and the United States.

MN Businesses Positive About Economy

A recent survey conducted by the Minnesota Department of Employment and Economic Development (DEED) and Federal Reserve Bank of Minneapolis indicated that Minnesota business service firms have a positive outlook about the economy. Over 90.0% of the 261 respondents said they expect the overall state economy to remain on its current course or improve in the next year, while 88.0% signaled expectations for revenue to increase or remain stable in the coming year.

New MN Jobs Announced by Employers

In addition to an optimistic statewide economic outlook, several companies announced plans during the second quarter to expand existing operations and add jobs. A jobs bill was approved in June that included public funding for Cirrus Aircraft to build out a 60,000-square-foot painting facility that will help keep existing operations in Duluth and is anticipated to help create between 150 and 300 jobs. Anderson Corporation had its official opening of the company’s newest manufacturing facility in Bayport in April. Accompanying the official opening was an announcement of plans for a second major expansion at the company’s Cottage Grove and North Branch facilities, which is projected to add over 300 new jobs. Artic Cat, Blattner Energy, Caterpillar, Dubow Textile, Mendell, Inc., and Rahr Malting Corporation also announced plans for expansions during second quarter that could combine to add up to over 150 jobs and roughly $200 million in investments.

Residential Real Estate Market on the Upswing

After another sluggish start in the early months of 2015, the for-sale residential market experienced improvements through the first half of 2015. Total existing home sales at the national level were up nearly 10.0% year-over-year in May of 2015, while the median home sale price increased by 7.9% during this period, rising to $228,700 in May of 2015. Supported by more first-time buyers entering the market, total existing home sales increased year-over-year for the 8th consecutive month in May. First-time buyers accounted for over 30.0% of home sales in May, up from the year prior, while the percentage of sales to investors, cash sales, and distressed sales all decreased during this same period. Healthy employment growth and compelling rent-to-own metrics are expected to continue to convince some tenants to leave the renter pool in favor of homeownership and encourage activity in the for-sale residential market.

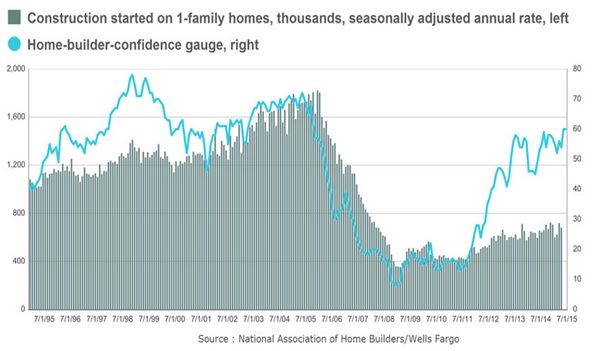

Home Builders Most Optimistic Since 2005

Recent consumer trends have given home builders a more optimistic outlook, and bolstered by strong growth in new orders, confidence among home builders rose the highest levels since the fourth quarter of 2005. The National Association of Home Builders/Wells Fargo Housing Market Index increased to 60 in June of 2015, up from a reading of 54 in the previous month and 52 at the close of the first quarter of 2015. In spite of rising confidence among home builders and stronger home permitting activity, single-family home construction starts, though increasing, remain modest compared to more historical norms. The following graph presents a ten-year historical view of construction starts and home builder confidence.

Twin Cities Residential Market Strong

Conditions in the Twin Cities for-sale residential market are stronger than the national level. Although average days on market remained unchanged on a trailing twelve month basis, home sale transactions in the Twin Cities market were up 15.9% through the first six months of 2015 compared to the first six months of 2014, while pending sales were also up significantly. New listings increased by nearly 10.0%, yet the for-sale inventory declined by 9.4% in June of 2015, as the supply of available inventory fell to 3.6 months in June. Spurred by more robust transaction activity, a limited amount of available inventory, and declining distressed sale activity, the median home sales price increased by 9.0% in the first half of 2015. Looking forward, stronger home sale prices should begin to encourage homeowners to bring more inventory to market.

Apartment Market Healthy

At both the national and local levels, progress in the for-sale residential market has yet to adversely affect conditions in the apartment market, though demand is likely to struggle to keep pace with the amount of new supply scheduled to be delivered over the next 12 to 18 months. Despite a robust construction pipeline and wave of new deliveries, the vacancy rate in the national apartment market stood at 4.2% in the second quarter of 2015, remaining essentially unchanged. Effective and asking rents were up 3.6% and 3.4%, respectively, on a year-over-year basis in June. Occupancy levels within the Twin Cities apartment market have remained strong in recent years and rent growth is being observed across all submarkets in the local market.

Favorable demographic trends remain intact to support healthy absorption and maintain strong occupancy levels in the apartment market. Facilitating demand, the pace of new household formation is projected to increase in near lock step with an expanding economy and growing employment base, while immigration will also add to the pool of potential renters. Although demand drivers are in place to support solid absorption figures, operating fundamentals in both the national and local apartment markets will continue to be tested by the addition of new supply through the near-term. Approximately 150,000 units are scheduled to reach lease-up at the national level in the final six months of 2015, and new apartment construction remains strong in the Twin Cities market. Although unemployment rates and the overall labor market have improved in recent years, we anticipate the pace of rent growth within the Class ‘A’ segment will ease as new development reaches lease-up. We also anticipate effective rent growth among lower-tier properties will be comparatively modest until wage growth within the core renter demographic faces additional upward pressure.

Industrial Sector Activity Increasing

All major industrial markets have entered into at least the recovery phase of the real estate cycle, with most major markets demonstrating expansion. E-commerce trends continue to serve as a significant tailwind for the industrial sector, though posing a drag on the retail sector, while the manufacturing sector also continues to demonstrate overall expansion. E-commerce trends have provided a healthy boost in the local market, as the Twin Cities market becomes more important in the national distribution chain with the rise of next-day delivery.

Largely aided by demand for bulk distribution and logistics space, healthy absorption and tight occupancy rates are forecasted through at least the near-term in the industrial sector, but the pace of speculative building within the industrial sector may temper expansion in some markets. Despite increasing new industrial construction activity, the shorter development cycle for industrial development compared to other property types affords developers the ability to be more nimble and react faster to any change in market conditions. Further, consumer demand in terms of functionality and technology for industrial buildings is changing at a faster pace and making older inventory obsolete more quickly. Consumers are demanding higher clearance heights, larger bays, more room for parking, and ample space to allow for the loading and unloading of cargo.

Office Market Seeing Improvements

Although employers are squeezing into denser space and a more cautious outlook compared to previous cycles continue to serve as significant headwinds, the national office market has demonstrated solid improvements since the start of 2015, and vacancies in the office sector are projected to edge downward on positive absorption over the next 12 months. Absorption will remain strongest within the Class ‘A’ segment as tenants seek to lock in rents, and conditions will remain comparatively stronger in high barrier-to-entry markets and Central Business District submarkets.

While progress has been noted in recent quarters, the pace of new office construction activity is accelerating rapidly and concerns linger over pre-leasing activity for many of these developments. Top among concerns is whether demand has picked up enough to justify the addition of new supply or if tenants are simply shuffling from existing space to new space. At the national level, new office construction activity was up nearly 25.0% in the second quarter compared to the year prior and up over 100.0% compared to its recent nadir. Several major office projects are currently underway within the Twin Cities market that will test the depth and breadth of demand for office space. Regardless, given the length of the office development cycle, vacancy rates at both the national and local levels should continue to decline at a modest clip at least over the next six months, putting upward pressure on rents.

Retailers Vacancy Rates Expected to Decrease

Conditions in the retail market are moving in the right direction in spite of structural shifts in consumer preferences. Limiting competition for existing inventory, a relatively narrow construction pipeline in the retail sector should support vacancy compression and spur rent growth in the second half of 2015. Consumer spending and retail sales are forecasted to increase over the next 12 month, which should help support demand for space in the retail sectors, as retailers become more confident in potential expansion plans and the pace of store closings decelerates. Retail vacancy rates are projected to decrease 30 to 50 basis points compared to the prior year at the national level, while year-over-year rent growth is forecasted to exceed 2.0% by the close of 2015. Trends in the Twin Cities retail market will closely mirror trends observed at the national level.

Hotel Industry Activity Ticks Upward

Occupancy, average daily room rates, and RevPAR, three of the most closely followed metrics in the hotel industry, all demonstrated improvement in the first half of 2015. Adverse weather conditions served as potential headwinds in the opening months of 2015 for some markets, yet leisure travel levels ticked upward and have remained resilient to help pick up slack left from softer business travel figures. National hotel occupancy rates are projected to increase from 64.4% in 2014 to the low-to-mid 65.0% range for year-end 2015. In turn, stronger occupancy levels are expected to facilitate average daily room rate and RevPAR growth in excess of 5.0% year-over-year by the close of 2015.

Driven by stronger occupancy and room rates, hotel development and investment activity continues to gain momentum in the Twin Cities market. An entity related to New Orleans-based HRI Lodging purchased the Plymouth Building in downtown Minneapolis in May of 2015 for $20 million, with plans to renovate the property into a 290-room hotel. Meanwhile, a host of new hotel projects are already under construction or remain in the planning or proposal phase, including a new luxury hotel at Terminal 1 of the Minneapolis-St. Paul International Airport. On the investment front, Summit Hotel Properties closed on the its latest transaction in the Twin Cities market with the planned acquisition of the new Hampton Inn and Suites closing in April of 2015. Located at the southeast corner of Eighth Street North and First Avenue North in downtown Minneapolis, one block south of Target Center, the 211-room, limited-service hotel sold for $39 million or approximately $184,834 per room.

Stronger Fundamentals and Current Pricing Trends are Igniting Development Activity

Improving operating fundamentals, favorable financing, and sale prices exceeding previous peak levels are driving the pace of new construction activity. The breadth and depth of construction activity has increased across property types and markets. New construction activity has become increasing robust in primary markets, but activity is spilling over into secondary and even tertiary markets. While activity is strongest within the apartment and industrial sectors, development is also becoming more widespread across other major and niche property types. Further, rising construction spending and overall activity is being supported by both private and public development. As an example of these trends, the Department of Homeland Security broke ground in the second quarter of 2015 on an $835 million, 574,000-square-foot National Bio and Agro-Defense facility in Manhattan, Kansas. More locally, while headlines have been focused on the robust apartment construction pipeline in the Twin Cities, development activity remains strong and diverse in several outstate markets, including the Mankato area.

Commercial RE Transaction Activity Strong

Healthy operating fundamentals, a low interest rate environment, increasing investor allocations towards real estate, and the relative stability of the United States drove activity in the commercial real estate market through the first half of 2015. Progress among operating fundamentals and improvements on the spatial side of the equation have been notable, yet strong transaction volume is highlighting the strength of the commercial real estate market.

At the national level, sale transaction velocity has remained healthy, but strong sales volume in the last several quarters has been supported by a number of portfolio and entity-level transactions, which are occurring across all property types. In April of 2015, Prologis, as part of a joint venture with Norges Bank Investment Management, announced the acquisition of a $5.9 billion portfolio from KTR Capital Partners. The portfolio includes 60 million square feet of industrial space contained within 322 properties as well as 3.6 million square feet of space currently under construction and a land bank that will accommodate up to nearly 7 million square feet of additional development.

In the office and retail sectors, portfolio and entity-level transactions have accounted for over 30.0% of year-to-date sales volume through the first six months of 2015. Transaction activity in the office and retail sectors is also being fostered by strong interest in sale-leaseback transactions. In May, an entity related to Chicago-based Mesirow Financial acquired a 1.4 million-square-foot corporate campus located in New Jersey in a $650 million sale-leaseback transaction. The sprawling corporate campus is leased to Verizon for an initial 20-year term that provides for options to renew or extend the lease. In June, TravelCenters of America agreed to sell 30 travel centers to Hospitality Properties Trust in a $397 million sale-leaseback transaction.

MN Experiences Strong CRE Activity

Similar to conditions at the national level, sales volume for commercial real estate assets remains healthy in the Twin Cities market. Although transaction velocity remained flat on a year-over-year basis, sales volume in the Twin Cities apartment market continues to be particularly strong, as investors do not appear overly concerned about the potential for fundamentals to be peaking. Through the first six months of 2015, year-to-date sales volume in the Twin Cities apartment market for conventional, market-rate 50+ unit apartment properties totaled approximately $285.5 million, up approximately 45.0% compared to the first half of 2014. Two sales involving Class ‘A’ properties in the urban core of Minneapolis accounted for over 30.0% of all sales volume in the Twin Cities apartment market during the first half of 2015, but the largest transaction involved a 402-unit suburban asset in the city of Woodbury, which sold for $54.25 million or nearly $135,000 per unit in May.

Real Estate Yields Attractive to Investors

Through at least the near-term, investors are likely to minimize exposure to bonds, and cash will continue to offer little to no return. Further, a negative return relative to even modest inflation offers investors little appeal to cash, and stocks remain at above-average valuations. Additionally, stock buybacks are becoming a more significant driver of earnings per share growth, indicating companies are struggling to identify long-term investments that will stimulate top-line growth. Significant risk exists within the stock market if multiples begin to compress and earnings growth becomes more sluggish. While current pricing does not reflect peak values for all markets, capitalization rates remain low and valuations for commercial real estate assets are strong compared to historical benchmarks, yet commercial real estate assets continue to have strong appeal to investors, due to favorable returns compared to investment alternatives and stronger upside as a result of improving market fundamentals.

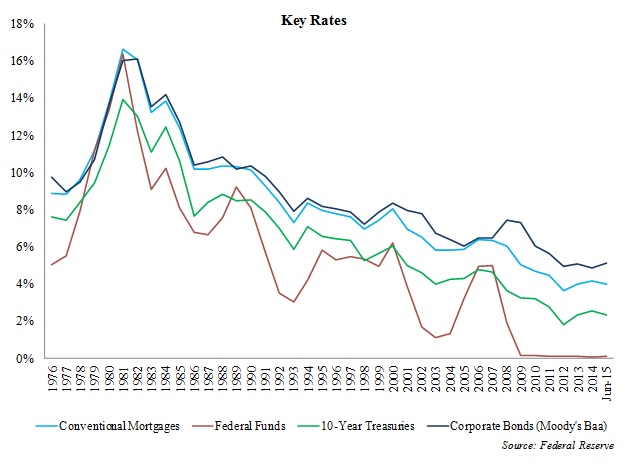

Global economic uncertainty and a likely rising interest rate environment domestically remain among the top concerns for the national commercial real estate market, yet both potential headwinds appeared to serve as an overall net positive for the industry in the first half of 2015. Concerns about the global economy are driving foreign investors in search of relative stability into the United States market, while commercial real estate assets continue to offer favorable yields and overall returns compared to other investment alternatives. Historically low rates and the availability of capital are also providing attractive financing opportunities, and key rates remain well below historic norms to support growth within the commercial estate market.

Capital Markets

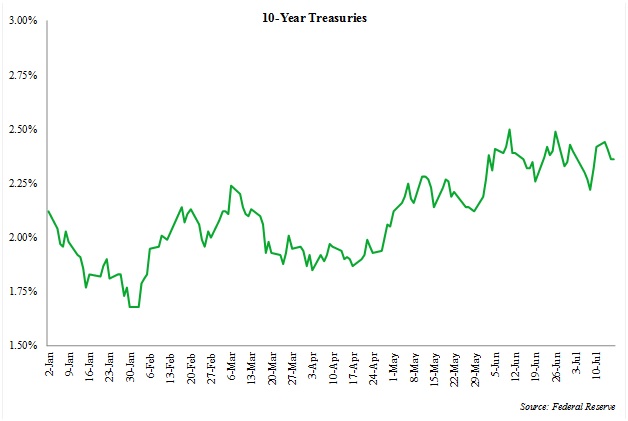

After reaching the most recent peak of 2.5% in mid-June, Treasuries rallied through the end of the second quarter and yields on 10-year Treasuries retreated to 2.35% at the close of June. Weak inflation and the relative stability of the United States are expected to prevent a massive exodus from investors in Treasuries, as events at the global level are putting a premium on safety. As a result, the 10-Year Treasury yield may demonstrate some volatility, due to the uncertainty of the Fed’s next steps, but is unlikely to increase significantly by the close of 2015. The following graph presents the year-to-date 10-year Treasury yield.

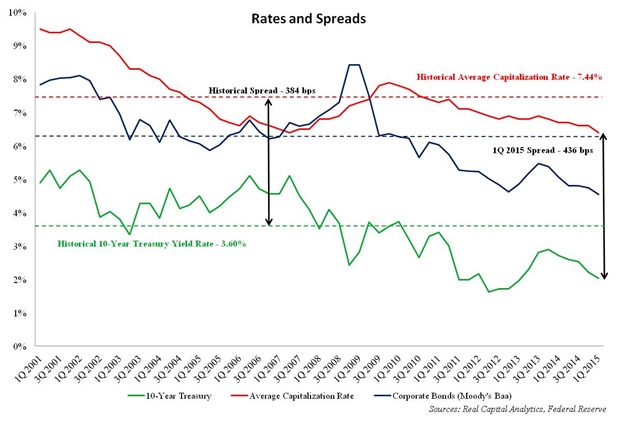

Barring a dramatic or jarring increase in interest rates, strong investment demand for commercial real estate assets and a wider risk premium spread compared to historical norms are expected to hold cap rates at historic lows through the near-term. In addition to strong investment demand, the anticipated pace of interest rate hikes will still afford investors with a low cost of capital for a significant period and will likely be accompanied by a more optimistic economic outlook. As of the first quarter of 2015, the average capitalization rate spread over 10-year Treasuries stood at 436 basis points compared to a historical average spread of 384 basis points, while the average capitalization rate to corporate bond yield (Moody’s Baa) maintained a favorable relationship. A wider spread suggests that, even in a likely rising rate environment, the market could absorb some small shocks and maintain a low cap rate environment through spread compression, as risk spreads appear poised to narrow closer to historical patterns. The following graph presents historical average capitalization rates (all four major property types), 10-year Treasury yields, and corporate bond yields (Moody’s Baa).

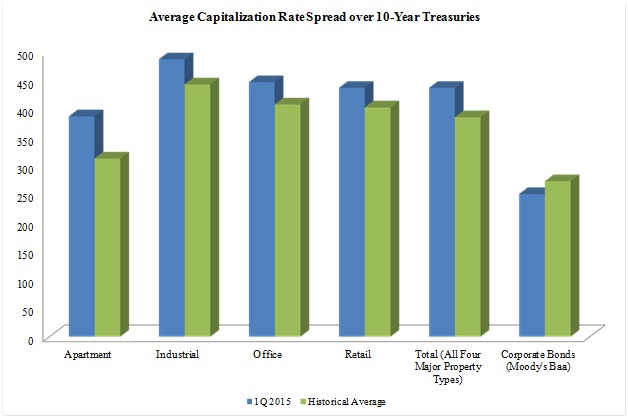

Among property types, the average capitalization rate spread over 10-Year Treasuries is widest compared to the historical average within the apartment sector, though spreads remain wider compared to historical among all four major property types. As of the first quarter of 2015, the spread within the apartment sector was 386 basis points compared to a historical average of 312 basis points. In comparison, the spread between yields on corporate bonds (Moody’s Baa) and 10-Year Treasuries, as of the first quarter of 2015, remained below the historical average. Competition among buyers for commercial real estate assets is expected to remain healthy in the final six months, and as a result of strong buyer interest and wider spreads, capitalization rates are likely to remain relatively unchanged from current levels by the close of 2015.

Rate Liftoff by Fed Could Occur in December 2015

A majority of traders are assuming a rate liftoff by the Federal Reserve in December, but even while the economic outlook has improved, there is no certainty that rates will rise in 2015. Several recent comments made by members indicate the Fed will be more cautious of raising rates too early than too late. Recent analyses completed by Morgan Stanley and Deutsche Bank suggest the first rate hike will not occur until the first quarter of 2016. Moreover, the International Monetary Fund (IMF) urged the Federal Reserve in June to delay raising interest rates until the first half of 2016, after cutting its growth forecast for the second time in 2015. As of mid-July of 2015, the CME Fed Watch, a tool that helps gauge the market’s reaction to changes to the Federal Funds target rate, indicated the probability of a rate hike in September was 21.0% compared to 39.0% in October, 58.0% in December, and 74.0% in January of 2016. Overall, indicators suggest a realistic outlook is for the 10-Year Treasury yield to close the year in the mid-2.0% range before reaching up to 3.0% in 2016, as investor demand puts downward pressure on rates through the foreseeable future.

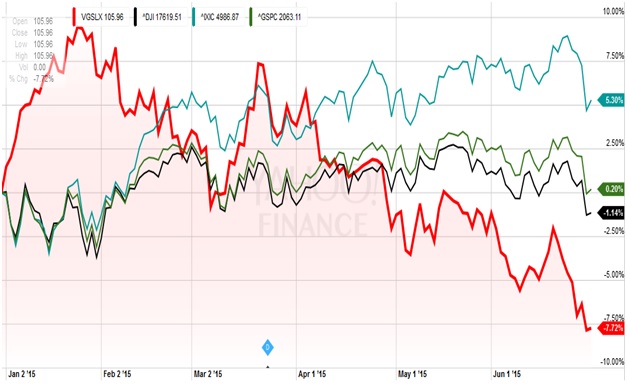

Public REITs Experience Declines

Lagging major indexes and renewed concerns regarding the threat of rising interest rates posed a significant challenge to the share prices of publicly-traded REITs in the second quarter of 2015, following a solid performance in the first three months of the year. While the case for operating fundamentals remains generally solid, concerns about rising rates, due to the sensitivity to bond markets, have created some jitters among investors. Shares in the Vanguard REIT Index Admiral Fund (VGSLX), one of the largest REIT mutual funds with over $46 billion in total net assets, declined 7.7% year-to-date at the end of June 2015. In comparison, the NASDAQ Composite Index was up 5.3% year-to-date at the close of the second quarter, while the S&P 500 remained essentially flat, up a mere 0.2% during this same period. The Dow Jones Industrial Average also declined in this six-month period, shedding just over 1.1% from the end of December of 2014 to the close of June of 2015. Given the broad-based decline in share prices among REITs, a number of REIT subsectors are trading at substantial discounts to their underlying net asset value. The following graph presents year-to-date performance of the Vanguard REIT Index Admiral Fund, Dow Jones Industrial Average, NASDAQ Composite Index, and S&P 500.

Hotel/Healthcare REITs Are Hit Hard

Hotel and healthcare REITs were among the hardest hit in the first half of 2015. Hotel REITs have primarily struggled due to concerns of an oversupply, while healthcare REITs have been hit hard as a result of investor perception of lower growth prospects compared to other REIT subsectors. Share prices of Ashford Hospitality Trust, Inc. (NYSE: AHT), Chesapeake Lodging Trust (NYSE: CHSP), and Host Hotels & Resorts, Inc. (NYSE: HST) all declined by more than 15.0% year-to-date at the close of the second quarter, while share prices of HCP, Inc. (NYSE: HCP), Sabra Health Care REIT, Inc. (Nasdaq: SBRA), and Healthcare Realty Trust Incorporated (NYSE: HR) were all also at least 15.0% lower at the close of June compared to year-end 2014. Residential REITs fared the best as a whole, with Home Properties Inc. (NYSE: HME), Essex Property Trust Inc. (NYSE: ESS), and UDR, Inc. (NYSE: UDR) all up over 2.0% year-to-date as of June 30, 2015. Home Properties, which agreed to be acquired by Lone Star Funds in an all-cash transaction valued at $7.6 billion in June, was up over 10.0% year-to-date at the close of the second quarter.

Market conditions appear ripe for additional consolidation within the REIT sector. Following the close of the second quarter, Chambers Street Properties (NYSE: CSG) announced an agreement to buy Gramercy Property Trust Inc. (NYSE: GPT) in an all-stock deal that is anticipated to close before the end of 2015. The merger will create one of the largest net lease REITs, with a combined portfolio including nearly 300 properties and approximately 52 million square feet of space. Parkway Properties, Inc. (NYSE: PKY) is also reported to be in the early stages of exploring strategic options, including a potential sale to another REIT or buyout firm.

Although publicly-traded REITs struggled in the first half of 2015, companies in even the hardest hit subsectors continued to pursue new acquisitions. Hotel REITs struggled mightily in the first half of 2015, as concerns over the expected amount of new supply to be delivered over the next 12 months mounted, yet transaction volume and acquisitions by publicly-trade hotel REITs remained strong in the first six months of 2015. Notable sales transactions included Host Hotels & Resorts, Inc. purchasing the Phoenician, a 643-room luxury resort at the base of Camelback Mountain in the Phoenix area, for $400 million, or roughly $622,100 per room, and the acquisition of the Four Seasons Hotel in downtown Austin for $197 million, or nearly $677,000 per room, by Strategic Hotels & Resorts, Inc. (HYSE: BEE).

Data referenced in this report was current as of July 17, 2015, and includes preliminary employment numbers as reported by the Bureau of Labor Statistics, which are subject to revision.

Fueled by the availability of financing and attractive yields relative to alternative investments, investors are optimistic about the outlook for commercial real estate. More capital is available in the market, boosting investor confidence, and the yields commercial real estate property is delivering remains favorable compared to alternative investments. Increasing by over 5.0% year-on-year in 2014, annual sales volume at the national level among the four major property types has risen for five consecutive years. Accounting for nearly 35.0% of all sales activity among the four major property types, rising sales volume was driven by the office sector during the year, while the biggest year-on-year increase in sales volume was noted within the retail sector. Strong fundamentals, favorable demographics, and a diverse employment and economic base continue to attract investors into the Twin Cities market. Property and portfolio sales of more than $2 million totaled approximately $3.8 billion in the local market during 2014, up roughly 20.0% from 2013. Mirroring national trends, sales volume in the Twin Cities was led by the office sector, which accounted for nearly 40.0% of all sales activity during the year. The apartment sector, however, posted the largest year-on-year increase in the local market.

Fueled by the availability of financing and attractive yields relative to alternative investments, investors are optimistic about the outlook for commercial real estate. More capital is available in the market, boosting investor confidence, and the yields commercial real estate property is delivering remains favorable compared to alternative investments. Increasing by over 5.0% year-on-year in 2014, annual sales volume at the national level among the four major property types has risen for five consecutive years. Accounting for nearly 35.0% of all sales activity among the four major property types, rising sales volume was driven by the office sector during the year, while the biggest year-on-year increase in sales volume was noted within the retail sector. Strong fundamentals, favorable demographics, and a diverse employment and economic base continue to attract investors into the Twin Cities market. Property and portfolio sales of more than $2 million totaled approximately $3.8 billion in the local market during 2014, up roughly 20.0% from 2013. Mirroring national trends, sales volume in the Twin Cities was led by the office sector, which accounted for nearly 40.0% of all sales activity during the year. The apartment sector, however, posted the largest year-on-year increase in the local market.